-

How American Business Makes the Super Bowl Happen

February 06, 2025

February 6, 2025

Chamber Bulletin KEY TAKEAWAYS

- From the food on your table to the commercials on your TV, businesses of all sizes make the Super Bowl possible.

- Small businesses and their workers would feel the impact of higher tariffs.

- Congress faces an important decision on tax policy that can drive economic growth.

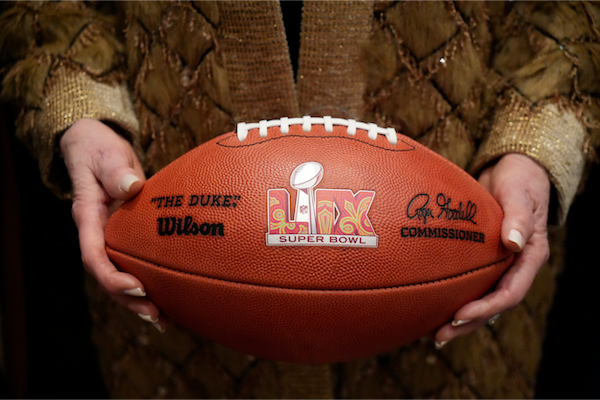

DEVELOPMENTS THAT MATTER How American Business Makes the Super Bowl Happen

The Super Bowl isn’t just a football game—it’s an economic engine that showcases the power of American business. From the food on your table to the commercials on your TV screen, businesses of all sizes make the magic of the big game possible.

Why it matters: The Super Bowl is a prime example of how businesses of all sizes work to bring important cultural and sporting events to life, drive economic growth, and create jobs.

- The Chamber’s Brought to You by American Business campaign showcases these efforts.

Eat up: The game’s impact ripples beyond New Orleans to hit the stomachs of millions of Americans. While Super Bowl Sunday is America’s biggest sports event, it’s also the second-largest food-centric event in the U.S., behind only Thanksgiving.

- 100 million pounds of chicken wings will be eaten.

- 11.2 million pounds of potato chips and 8 million pounds of guacamole will be eaten.

- 1 in 7 Americans will order takeout, fueling restaurants nationwide.

Bottom line: From making the game-day extravaganza come off without a hitch to putting smiles on sports fans’ faces all over the country, the Super Bowl represents the best of U.S. business in action.

Dig deeper:Read More ALL BUSINESS IS LOCAL Abundant American Energy Powers Communities

Energy is an enormous cost for businesses and consumers. When prices rise, businesses pass those costs to customers, straining household budgets and stressing local economies. Affordable energy is essential for thriving communities.

By reforming permits and cutting red tape, we can boost American energy production, create jobs, and secure a stronger future for all.

The State of American Business 2025 shows that the decisions made in Washington affect people, businesses, and communities across the country. Our leaders must prioritize growth and opportunity for all Americans.Learn More TOP OF MIND Minnesota Manufacturer Speaks Out on Tariff Threat Traci Tapani, co-president of Wyoming Machine Company in Minnesota and Vice-Chair of the U.S. Chamber’s Small Business Council, told the BBC that higher tariffs would mean higher costs for her company and could impact her employees.

What she said: “I think that one of the biggest impacts that we're going to see is that a primary input in a metal fabrication business is buying sheets of steel and aluminum,” Tapani said.

- “Both Canada and Mexico are large producers of those items, and so I fully expect that we'll see higher prices if those tariffs go into effect.”

- Tapani added that tariff threats make decisions harder about raises for her employees, who are feeling the pinch of higher prices.

Listen Congress Faces a Crucial 2025 Tax Decision Congress has to make a choice in addressing the impending 2025 tax cliff and avoiding the largest tax increase in U.S. history: deciding between a "current-law" baseline or a "current-policy" baseline.

Why it matters:- Under a current-law baseline, extending the 2017 Tax Cuts and Jobs Act policies would be seen as costing $4 trillion over the next 10 years.

- A current-policy baseline treats avoiding a scheduled tax increase as maintaining the status quo, not as a new tax cut. Only new tax policies or changes to existing ones would count as having a budgetary impact.

- Reflects reality: A current-policy baseline assumes Congress will extend existing tax provisions, aligning with historical precedent.

- Supports permanence: It allows lawmakers to make tax reforms permanent, avoiding recurring tax cliffs that create uncertainty.

- Addresses overspending: Adopting this baseline doesn’t hinder Congress from tackling overspending but provides flexibility for deficit reduction.

- Removes bias: It eliminates the current system’s bias toward spending increases and tax hikes, protecting taxpayers from unchecked government growth.

Read More SMALL BUSINESS, BIG IMPACT

Resources to Make You a Better Business Owner These 10 books, podcasts, and courses can help you develop leadership and managerial skills that improve your team's performance. Read More UPCOMING EVENTS 2025 Tax Policy Summit February 12, 8:30 AM – 5:00 PM ET The third annual Tax Policy Summit will take place in person at U.S. Chamber headquarters. The theme for this year’s summit will be “Scaling the 2025 Tax Cliff,” with a comprehensive look at the policies, politics, people, and processes involved. Register Tariffs, Trade, and Other Economic Trends March 14, 1:00 PM – 2:00 PM ET U.S. Chamber Executive Vice President Neil Bradley joins RSM US Chief Economist Joe Brusuelas to explore the key factors affecting middle market businesses. Register Critical Minerals Summit April 9, 9:00 AM – 12:00 PM ET Experts from government and business will dive into the key issues and innovations shaping the critical minerals supply chain. Register Contact Us Join Privacy Notice Privacy Notice EU U.S. Chamber of Commerce 1615 H Street, NW WASHINGTON, DC, 20062, US “U.S. Chamber” and “U.S. CHAMBER OF COMMERCE” are registered trademarks of the Chamber of Commerce of the United States of America

-

Navarre Beach Area Chamber of Commerce

info@navarrechamber.com | P: (850) 939-3267 | F: (850) 939-0085

8543 Navarre Parkway | Navarre, FL 32566

Copyright 2014 Navarre Beach Area Chamber of Commerce

/362.jpg)

/361.jpg)

/359.jpg)

/358.jpg)

/360.jpg)

/313.png)

/316.png)

/344.png)

/315.png)

/312.png)